A Northwestern Perspective: Criminal Law

The research and teaching of criminal law scholars at Northwestern University Pritzker School of Law covers a wide range of academic disciplines, from social psychology to economics, along with ...

05.14.2019

Scholarship Faculty

On May 17-18, the American Law and Economics Association (ALEA) 2019 meeting will be held at the New York University School of Law. Northwestern Pritzker School of Law has a long tradition of participating at the conference, which is the largest and longest running academic conference in the field of Law and Economics, and one of the largest interdisciplinary law conferences.

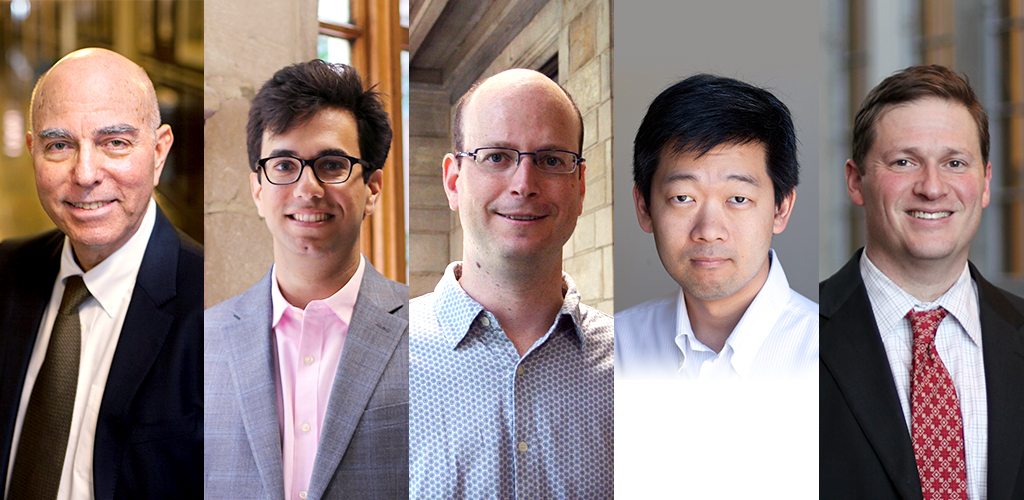

At the conference, Matthew Spitzer, Howard and Elizabeth Chapman Professor and Director of the Northwestern University Center on Law, Business, and Economics, will be awarded the American Law & Economics Review prize for his paper “Appointing Extremists,” with co-author Michael Bailey. He will also serve as a session chair.

Ezra Friedman, Professor of Law, serves on the Board of Directors of the ALEA, and will also serve as a session chair.

Alex Lee, Professor of Law; Sarath Sanga, Assistant Professor of Law; and David L. Schwartz, Stanford Clinton St. and Zylpha Kilbride Clinton Research Professor of Law are all presenting papers.

Below is a brief summary from each paper.

Matthew Spitzer, “Appointing Extremists” (with Michael Bailey)

Given their long tenure and broad powers, Supreme Court justices are among the most powerful actors in American politics. In this paper, we present a model of the nomination process that highlights the uncertainty about a potential justice’s preferences can lead a president to prefer a nominee with extreme preferences. In certain cases, Senators may also prefer extreme nominees, leading to the nomination and confirmation of justices whose preferences seem to diverge from those of elected officials. While our focus in this paper is on the Supreme Court, the analysis extends in many ways to other multimember appointed bodies as well.

Alex Lee, “A Model of Stock Market-Based Rulemaking”

We consider the extent to which a regulator can harness information about its proposed regulation from stock-price movements of affected firms in the context of rulemaking. In our model, a regulator proposes a rule that would apply to a large number of firms, and speculators gather firm-specific information to ascertain the rule’s effects and trade on it. The regulator, however, conditions the rule’s adoption on positive aggregate market reactions. We find that if the proposed rule’s ex ante expected value is positive and the regulator relies on the market completely, then as the number of firms increases, the speculators will trade as if the rule’s adoption is certain, and stock prices will exhibit maximal informativeness. When the proposed rule’s ex ante expected value is negative, however, the regulator’s reliance on the market will completely dampen the speculators’ incentive to gather information in the limit, and stock prices will be completely uninformative. In extensions, we also consider the presence of a stakeholder who may be motivated to manipulate the market and steer the regulator to a certain outcome that is privately beneficial.

Sarath Sanga, “Fiduciary Obligations in the Presence of Multiple Classes of Stock” (with Eric Talley)

This paper develops a game theoretic framework to study the increasingly common conflict between common and preferred shareholders regarding whether to liquidate the firm or continue. In our model, common tend to inefficiently continue while preferred tend to inefficiently liquidate. Taking a cue from recent case law, we explore whether it is possible to use damages (for either “wrongful exit” or “wrongful continuation”) to align the interests of common and preferred in maximizing firm value. We show that there always exists an efficient damages rule if the interests of preferred shareholders control the exit/continue decision. When common control the decision, however, an efficient damages regime may either fail to exist or may require supracompensatory damages. Our framework also suggests that ex ante contracting need not give rise to an efficient damages rule, particularly if investment capital is relatively scarce. Our findings have implications for the ongoing debate about how to assign fiduciary duties and rights within privately held firms with multiple classes of stock.

David L. Schwartz, “Gender Discrimination in Online Markets” (with Christopher Anthony Cotropia and Jonathan S. Masur)

We studied whether a seller’s gender impacts the bargained-for price in a product market, specifically baseball cards, and attempt to unpack the reasons for any discrimination that might be present. We accomplish this by use of two experiments, a field experiment in which we actually sold baseball cards on eBay, and a laboratory experiment using surveys on Amazon’s Mechanical Turk (MTurk). Contrary to prior studies of the role of gender in the marketplace, we found evidence of discrimination in favor of female sellers in both experiments. Female sellers sold baseball cards for a higher price and greater profit compared to the males. As for the reason, our survey evidence suggests that the higher price appears to be at least partially because respondents believe that female sellers were more likely to handle the card carefully and promptly mail it after purchase, and less likely to present problems in completing the transaction.

The research and teaching of criminal law scholars at Northwestern University Pritzker School of Law covers a wide range of academic disciplines, from social psychology to economics, along with ...

Northwestern Pritzker School of Law is home to an incredible group of faculty members working at the intersections of law and many other disciplines. Their research and scholarship has helped ...

Northwestern Pritzker School of Law is home to an incredible group of faculty members working at the intersections of law and many other disciplines. Their research and scholarship has helped ...